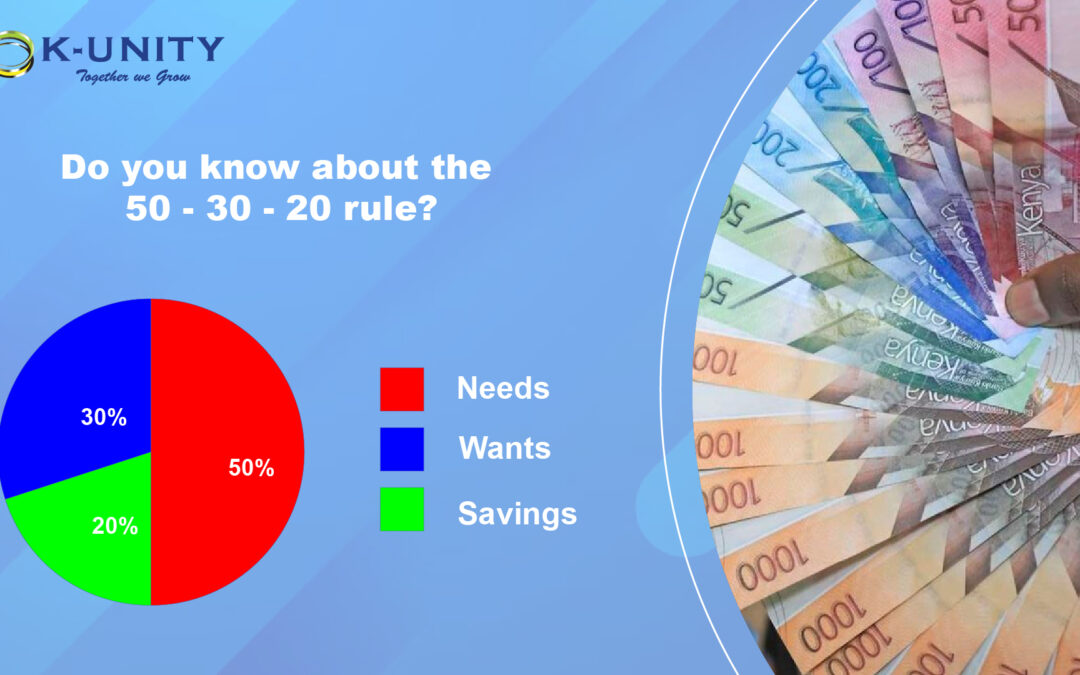

The 50-30-20 rule is a popular method for allocating the different spending categories in a personal budget. The rule directs 50% of your after-tax income to necessities, 30% to things you don’t need but want, and the remaining 20% to debt repayment and/or savings.

The 50-30-20 rule is a general guideline about how to divide your pay; it is not intended to be a precise budgeting law.

How to Create a 50-30-20 Budget

The 50-30-20 rule is the first step in creating a budget, which you should do each month to help you allocate your income towards your short-, medium-, and long-term objectives.

Using your most recent paychecks as a base, start with your monthly post-tax income.

50% should go to necessities

After determining your income, look at your bills, including those for rent or a mortgage, a car, gas, electricity, and phone service. Then calculate how much you typically spend each month on groceries. These are your absolute necessities. When you add everything up, if it equals 50% of your take-home pay or less, you’re already on track to stick to a 50-30-20 budget.

Consider where you could make savings, if it represents more than half of your income. Do you need that car for work, or are you just using it for weekends of cruising? How much do you pay to park it? When grocery shopping, are you mindful of your spending limits? And some of the beverages you consume are probably in the wants category.

30% should go to your wants

After deducting your necessary expenses from your post-tax income, it’s time to examine how you spend the remaining money. You can see your spending on entertainment (including television and streaming services), eating out, traveling, shopping, and self-care on your bank and credit card statements. To get a sense of your average spending and how it compares to your income, look back over a few months. If the reduction is greater than 30%, consider which of these pleasures you’ll miss the least before making some cuts for the upcoming months.

20% should go to building wealth and paying debts

Discipline is needed for the final 20%, which includes saving and paying off debt. It can be tempting to put off saving money and make only the bare minimum payments on your debt each month, especially if you’re just getting started.

Consider your savings goals if your debt is manageable and 20% of your income is designated for savings. Having six months’ worth of expenses saved up in an easily accessible emergency fund, typically a savings account, is advised by many experts. However, you might want to think about opening an individual retirement account if you’re saving for longer-term objectives like retirement. Contribute as much as you can to your employer’s retirement plan if it is available, especially if they match a portion of your contributions.

Conclusion

It might be impossible to reach those numbers in the short term when you’re just getting started. An entry-level salary, for instance, can easily be consumed by the rent of a modest apartment in Nairobi. And in the future, changes in your life—like the birth of a child or a change in your career—might interfere with your 50-30-20 targeting.

It’s a guideline rather than a rigid requirement. Just be sure to get back to 50-30-20 as soon as you can if you experience a setback.

In the same vein, feel free to increase the savings rate above 20% when the budget is healthy. Your future self will appreciate it one day.

If you want to start saving, K-unity SACCO is one of the best places you can do that. K-unity is a first-tier SACCO that has an asset base of over KES 5.7 billion. We have 17 branches in 5 counties and a membership of over 70,000. K-unity is one of the best and oldest SACCOs in Kenya, having been in operation for over 50 years. You can open an account by clicking the following link: https://bit.ly/3WfIQ2F Kindly call, text, or WhatsApp us at +254 707 424 774 for more information.